Introduction

Recently I read the book The upside of inequality. I would recommend it cautiously. It contains original views but, for some, it might be too radical. They would need a gentler introduction.

The author, Edward Conard, builds his case for inequality. He explains how it starts, why it is good for us, and what equality means. He debunks the claim: if we tax rich people more, we would be better off.

Why inequality grows

We know that inequality grows as society develops. Nomads own what they can carry. In a farming society, some people have a castle. Some are peasants. Now, you can buy many things if you have money.

In the past, life sucked for everyone. Even the rich could not own too much. An invention that is not accessible for everyone increases inequality (for instance, toilet paper). Now, people can be a lot richer than the average. There are many things to buy. Also, people can be a lot poorer than the average (and they don't die).

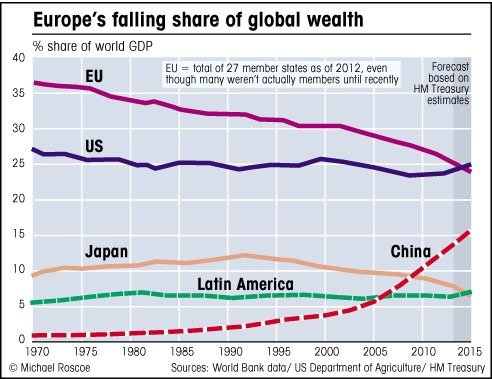

During the growth, the wealth of the rich grows faster than the wealth of the poor. The reasons are obvious: the rich can more easily invest. Historically, the only way to reverse the trend was war or revolution.

There is also one more factor. Productivity is increasing (inequally). In the past, a musician and a waiter could service one room. Nowadays, the waiter is stuck at the same productivity, whereas a musician can play for millions.

The more we invest, the more inequal we are getting. But investments are the greatest. Thanks to investments, the proportion of GDP we pay for food from 18% to 10% in the last 60 years. We are better off with investments and inequality than with equality.

Risk

For starting a company, one needs capital and willingness to bear risk. Capital is straightforward. To produce, you need tools and education. Tolerating risk is complicated.

Investments are not safe. If you buy a farm and a tractor, there might be a drought. If you create an app, nobody might download it. (This is a problem I know a lot about)

Some projects are riskier than others. If you want to farm, the probability of drought is small. If you plan to cure cancer, you will probably fail.

People invest in risky projects because they expect to get more money than if they invested safely. Pharma company that invests in the cure of cancer with the probability of succeeding 0.01% expects to get more than 10 000 times more if it works out.

Taxes disregarded this. For one successful test, there need to be many failed ones. If one company does them all, we view the failed investments as cost. But if companies compete, the cost of innovation is dispersed, and the win is taxed more.

Example: Invest 2 with a chance of 99% to lose everything and 1% to get 400. It is a favorable bet. On average, you double your money. If taxes are 50%, if you succeed, you pay 199 (=(400-2)*0.5) on taxes, so now, you break even.

Suppose you can pay 2 for the previous bet or for a one where you win 3. Without taxes, in expectation, you get more by taking a risk (4 versus 3). If you are taxed, you should choose the riskless option (2.01 versus 2.5).

We innovate less, thanks to taxes. Innovation is risky, and the state captures the benefits.

Debunking myths that support redistribution

Maybe we should redistribute. Maybe the people were not motivated by the money to work. Maybe they were just lucky, and therefore they don't deserve the money. Maybe they do nothing useful with the money.

Incentives do matter

There is no lone innovator. Everyone stands on the shoulders of giants. For an enthusiastic entrepreneur, there needs to be venture capitalists and workers that take the risk. We need to motivate also the people around, to have some share in the innovation.

The innovation helps the customers surely. Sometimes the innovator has something from it. Imagine a new network that connects you with your friends (Friendster). Your life gets better if you are using it and it saves you 1 euro every month (catching up with friends, finding old ones). The company does not cash in all this money. There might come a competitor (Facebook) that takes over the customers. Generally, this is happening, and the innovative companies capture only 5% of the value they create.

So we live in a world where innovation is risky, and it's hard to capture anything from it. Heavily taxing those who can capture something discourages innovation. Cross-country comparisons show a correlation between inequality and growth.

Success is earned

Wage discrepancies within companies are usually more or less the same. The problem is that some companies are more successful than others and can afford to pay more.

Most very wealthy people did earn their money. Only 30% of the richest people are not self-made entrepreneurs.

CEO pay is enormous. By this, we don't motivate him to work harder, but maybe to take more risks. Moreover, CEOs' wage has not risen relative to the value of the company they manage.

Public spending doesn't help

If the government is good with spending money (better than companies themselves), high-wage high-taxes countries should grow faster on average. They do not.

Mobility is high

The book also analyses social mobility in the US. The mobility is similar to Europe. The US is disadvantaged. They accept poor migrants.

Being poor in the US is not that bad

But there is also a moral argument. If others are dying, we should help them. That's not the case.

The government's help decreases the work participation of the poorer. It makes them dependent on help in the future and doesn't get them out of "poverty."

Nowadays (written even before covid), it's sensible to work a little. In the lowest quintile, people work half the hours of a full-time worker. With benefits, they earn more than 30 dollars an hour.

Environment is important

The US is sucking talented people from the rest of the world. Migrants are responsible for between ten and twenty percent of productivity growth.

They are attracted to a society that is more favorable to bearing risk. Moreover, it had built an environment around that.

Interesting thoughts

Taxes should increase productivity. They should make bad behavior more costly and good behavior better. Taking risks and succeeding is a good thing. Even taking a risk and then failing (taking the risk is the prerequisite for succeeding).

Even if it's not implementable, a tax for underdeveloping your talent is justifiable. For instance, someone who studies for a useless degree and his pay suffers because of that is at fault for not developing his talent. That should be as bad as smoking.

The data support this. Only 7% of founders are outside STEM, healthcare, law, economics, and business.

Conclusion

The book argues that the focus on equality harms the risk-taking culture. Risk-taking is what is pushing the growth and increasing the standard of living.